Though the factoring feature was only recently launched, its potential to transform the user experience and drive business growth is clear. By integrating factoring directly into the Pennylane platform, users can now manage their cashflow needs end-to-end without leaving the app. This holistic approach simplifies workflows, saves time, and provides a compelling reason for users to upgrade to or stay on the Pro account.

For Pennylane, this feature opens a new revenue stream while reinforcing their position as a comprehensive financial platform. The tight collaboration between teams, seamless design execution, and focus on user-centricity ensured the project was a success. As the feature scales, it’s poised to not only drive adoption of the Pro account but also solidify Pennylane’s reputation as a trusted partner in financial innovation.

Pennylane is a cutting-edge accountant and finance platform designed to streamline cash flow management for businesses, SMEs, and entrepreneurs. Their desktop app empowers users with intuitive tools for managing day-to-day finances, helping their clients thrive in today’s competitive business landscape. Among their standout features is the Pro account, a premium offering providing powerful services aimed at not only simplifying financial workflows but also enabling users to boost their revenue.

Despite their robust platform, Pennylane faced a significant challenge: the Pro account, a vital revenue stream and value generator, was underutilised by their customer base, with only 17% of users subscribing. To grow their Pro user base and improve retention, they needed to deliver a more compelling value proposition. Enter a transformative project centered around factoring on receivable invoices, designed to drive acquisition, retention, and revenue generation.

Pennylane’s clients rely on their innovative financing options, including wallet financing, which allows users to access loans repayable within 120 days. However, a regulatory change reduced this repayment window to 45 days, leaving clients in need of a more flexible cashflow solution. To address this, Pennylane partnered with Defacto, a trusted factoring provider already favored by many of their users.

This collaboration presented an opportunity to integrate factoring directly into the Pennylane platform. By doing so, users could access invoice financing seamlessly, unlocking much-needed cashflow flexibility while staying within the platform ecosystem. Pennylane needed a product design strategy that would make the feature intuitive, user-centric, and acquisition-driven—all while meeting a tight deadline. That’s where I stepped in to lead the charge.

My role involved spearheading the product design, UX/UI, and strategy for the new factoring feature. To begin, I immersed myself in understanding Defacto’s API capabilities, collaborating closely with their technical team to ensure a seamless integration. Regular sessions with Pennylane’s front-end and back-end developers were pivotal to aligning design aspirations with technical feasibility, ensuring every detail was actionable within the short timeline.

Collaboration extended beyond just technical teams. The factoring feature impacted Pennylane’s Invoicing team, necessitating consistent communication to avoid disrupting their existing workflows. My work included user testing to validate designs, writing detailed user stories—an initiative new to Pennylane—and quality-assurance checks to ensure the final product delivered a polished experience. Along the way, I mentored a junior PM on the project, fostering team confidence and alignment, and exemplifying a holistic approach that went beyond design responsibilities.

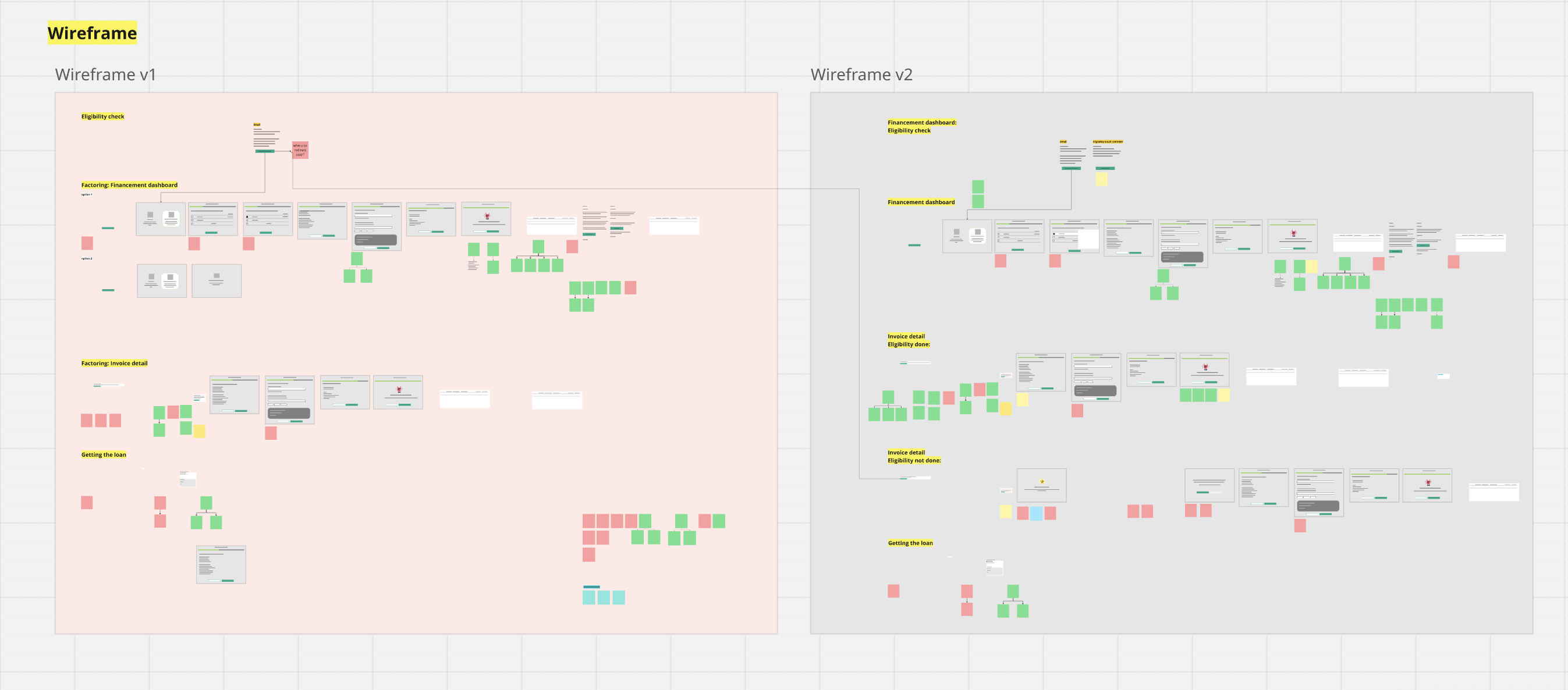

The factoring feature was designed and launched in strategic phases to target key user groups. Phase 1 focused on Pro users, with a streamlined flow for those already eligible for invoice financing. These users could select eligible invoices, input any missing details, review loan terms, and await disbursement—all within the Pennylane platform. Users who hadn’t completed their eligibility were guided through an additional step before joining the main flow. Regular email updates and a dashboard displaying loan statuses ensured a transparent user experience.

Phase 2, designed but deferred due to time constraints, envisioned initiating the loan journey directly from the Pro account dashboard. Phase 3 aimed to extend the feature to free plan users, leveraging marketing strategies to drive conversions to Pro accounts. Despite the tight timeline, Phase 1 was delivered on schedule, laying the foundation for subsequent phases to amplify user engagement and platform adoption.

Want to know more on how I can help you or simply have a chat?