Within a short period, 15% of MCB’s customer base had tokenized their cards, embracing the convenience and efficiency of cashless payments. This not only aligned with MCB’s vision of fostering a cashless society but also drove increased card usage, directly contributing to the bank’s revenue growth.

Beyond the numbers, the project demonstrated MCB’s commitment to innovation and set a benchmark for digital payment solutions in Mauritius. Developers and stakeholders praised the collaborative process, noting how my involvement streamlined complex integrations and ensured a user-centered approach. Together, we delivered a product that exceeded customer expectations and solidified MCB’s position as a leader in digital transformation.

This case study exemplifies the power of innovation and collaboration in delivering meaningful change. By merging technical expertise with user-focused design, MCB Group and I successfully reimagined how Mauritians transact—ushering in a new era of financial convenience.

MCB Group, the largest bank in Mauritius, has long been at the forefront of innovation in the financial sector. With a reputation for driving change and improving customer experiences, the bank has consistently sought to redefine how people interact with their finances. As part of their ongoing digital transformation, MCB aimed to support a cashless society by introducing a seamless and innovative way for customers to transact—using their smartphones.

This initiative aligned perfectly with the needs of their diverse customer base, who were increasingly demanding convenience and digital-first solutions. While tourists were already benefiting from NFC payment technologies on local POS systems, Mauritian customers lacked access to similar services. The market was ripe for disruption, and MCB’s vision for a pioneering issuer wallet on their Juice banking app marked a significant step toward that goal.

The world is moving rapidly toward digitization, and the global shift away from paper money is gaining momentum. MCB recognized that providing NFC payment options would not only modernize the Mauritian payment ecosystem but also open up new revenue streams. With existing infrastructure already supporting NFC payments, MCB saw an opportunity to extend this capability to their local customers while capitalizing on the growing popularity of contactless payment methods abroad.

Their mission was clear: to create a seamless, user-friendly experience that would remove barriers to payment, foster new behaviors, and drive innovation in the local market. The challenge was to balance speed-to-market with robust development while maintaining their reputation for delivering high-quality digital solutions. That’s when I was brought on board to help bring this vision to life.

Collaborating with key stakeholders such as VISA, Entrust, and Mastercard, I worked to design and implement an end-to-end user experience that met both technical and usability standards. My first priority was understanding the complex API landscape, bridging VISA’s tokenization services with Entrust’ intermediary systems and MCB’s banking infrastructure. This required deep dives into technical documentation and close collaboration with developers to ensure that every interaction would be seamless for end users.

The phased rollout strategy was crucial to the project’s success. We decided to first launch the feature for VISA credit card holders, a smaller subset of users, to ensure the system’s stability. Once the foundation was proven, subsequent phases included Mastercard credit and debit cardholders, followed by digital card management. Given the unique constraints of the Mauritian market—such as Apple’s unavailability for wallet integrations—the solution was built exclusively for Android users. Despite the challenges, my process prioritized usability, compliance, and a seamless customer journey.

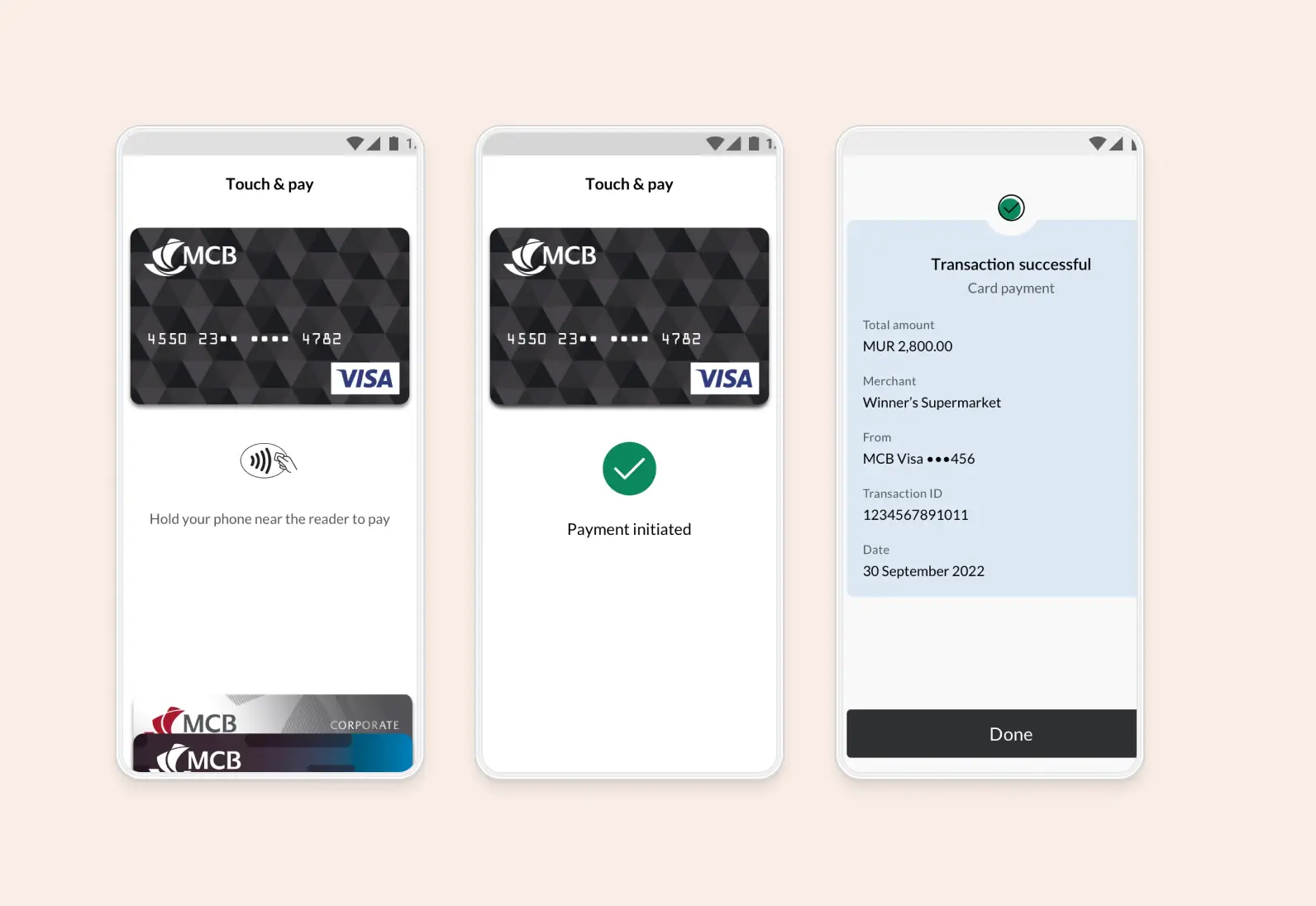

The final product was a highly technical yet intuitive feature embedded within the Juice banking app. Users could tokenize their physical cards, enabling them to make NFC payments directly from their smartphones. The experience accounted for critical edge cases, such as offline payments and payment failures, ensuring reliability in any situation.

What set this solution apart was its innovative approach to user experience within a banking app. While most issuer wallets are built into standalone services like Google or Samsung Wallet, MCB’s wallet was fully integrated into their existing ecosystem. This provided customers with a familiar interface while introducing a cutting-edge way to transact.

Want to know more on how I can help you or simply have a chat?